A Step By Step Guide On How To Pay Car Token Tax Online?

Do you prefer convenience over standing in long queues for car token tax payments in Pakistan? Yes, e-payment for car token tax is now possible. In today’s online world, paying vehicle taxes merely requires a few clicks. The days of waiting for your turn while standing in lengthy lines are long gone. It eliminates the need for documentation while also saving you time. Vehicle owners must understand the method of how to pay token tax online.

The method of paying token tax registration online varies between provinces, such as Punjab, KPK, or Sindh. The online token payment method has enhanced flexibility and convenience. One can now conveniently pay the token tax from the comfort of their own home. We’ll cover every facet of how to pay car token tax online in this extensive tutorial.

What Is Car Token Tax & Its Need?

The excise and taxation departments in each province of Pakistan impose a specific annual fee on car owners, known as the Car Token Tax. This fee applies to all vehicle owners. Road upkeep and other infrastructure projects are funded by the government using the tax revenue received. Paying motor vehicle tax online ensures compliance with regulations and protects you from heavy penalties.

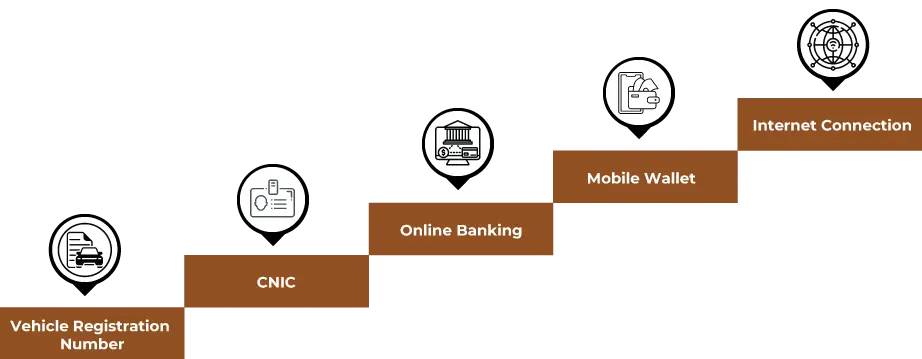

Preconditions For Online Car Token Payment

There are some important conditions before you proceed on how to pay car token tax online. These necessities include the following:

- Having a correct vehicle registration number is mandatory. It helps to retrieve the data related to your vehicle.

- A national identity card or CNIC is also required for the verification step.

- For a smooth payment method, ensure your access to the Online Banking Or Mobile Wallet.

- For a successful completion of online payment methods, you should have a good internet connection.

Online Car Tax Payment Platforms in Pakistan

Before going to the steps on how to pay car token tax online, it is necessary to know the payment platforms. There are different platforms, whether you want online token tax payments Sindh, Punjab, or KPK.

1. Excise and Taxation Department Websites

You can pay the token tax online on the websites of the excise and taxation departments in each Pakistani province.

Punjab: An excise and taxes website is available. It helps in online token tax payments in Punjab. The name of the website is ePay Punjab. Punjab Gov. https://epay.gov.pk/

Sindh: You can pay taxes and check your token tax status online. It could be done by using the Sindh Excise website. https://excise.gos.pk/KPK

KPK has an excise and taxation portal. It enables online payment of Token tax. This is the app: https://www.kpexcise.gov.pk/

Balochistan: The Excise and Taxation website of Balochistan allows you to accomplish a lot of things. It includes online tax payment and vehicle verification. www.excise.gob.pk/

2. Mobile Wallets

If you don’t want to use the official website for token tax verification or payment, there are other alternatives. These alternatives include Jazzcash, Easypaisa, and some other similar platforms for e-payment.

3. Banking Apps

There is also a mobile banking online token tax app. Different banks in Pakistan integrate the excise department, which facilitates the payment method.

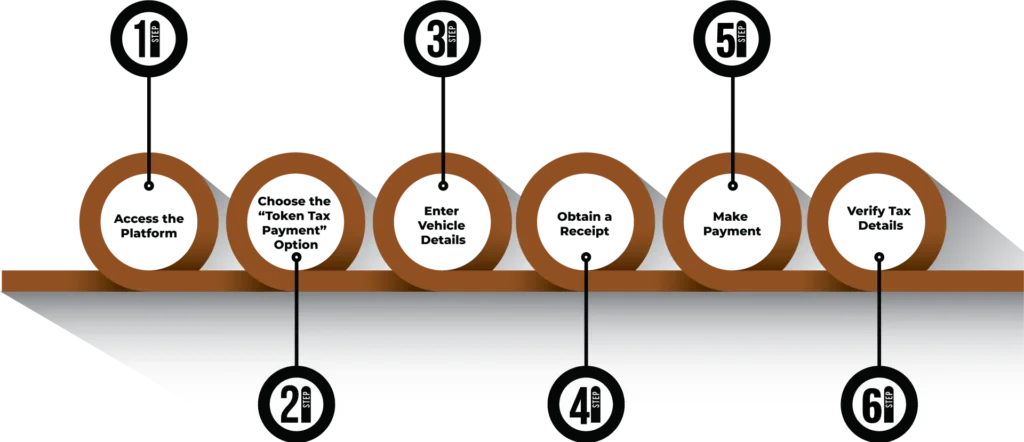

6 Easy Steps On How To Pay Car Token Tax Online?

Here is the easy procedure of token payment for car owners in Punjab, Sindh, Balochistan, and KPK. Discover the fundamentals of how to pay car token tax online.

Step 1: Access the Platform

Go to your province’s e-pay website or download the e-pay app on your smartphone.

- For Punjab: ePay Punjab

- For Sindh: Sindh Excise Website

- For KPK: KP Excise And Taxation Portal

- For Blochistan: Excise, Taxation, Government of Balochistan

Step 2: Choose the “Token Tax Payment” Option

After downloading the app, you can access various services, such as traffic challan payment, car verification, car transfer, and token tax payment. From the list of services, choose the option of Excise and Taxation. In the excise and taxation service, a token tax payment option should be selected.

Step 3: Enter Vehicle Details

Retrieve every detail of your vehicle by adding a valid CNIC and vehicle registration number. The platforms are designed for different purposes, whether you want to check token tax, Islamabad car token tax online, or token tax verification.

Step 4: Verify Tax Details

After this step, the calculated tax amount and the penalties will be displayed. Revise all the details carefully for payment.

Step 5: Make Payment

Now select your preferred method for the payment of token tax. Choose if you want to pay token tax using banking apps, mobile wallet including Jazzcash or Easypaisa, or credit or debit card.

Step 6: Obtain a Receipt

A receipt will be generated by the system following the payment. You can save and download the receipt as proof of payment.

Renewal Procedure Of Token Tax In Punjab, Sindh, KPK, Balochistan

Customers who want a renewal of token tax must follow the easy steps listed in this guide.

- Access the epay website or app of the province.

- You will get a view of the service list. Choose token tax renewal from here.

- Now, enter vehicle details like CNIC and registration number of the vehicle.

- At this point, you will get a renewal fee of token tax. Review it for further payment.

- Use the renewal method that suits your comfort or needs.

- You will receive a receipt upon payment; preserve it and download it as evidence of renewal.

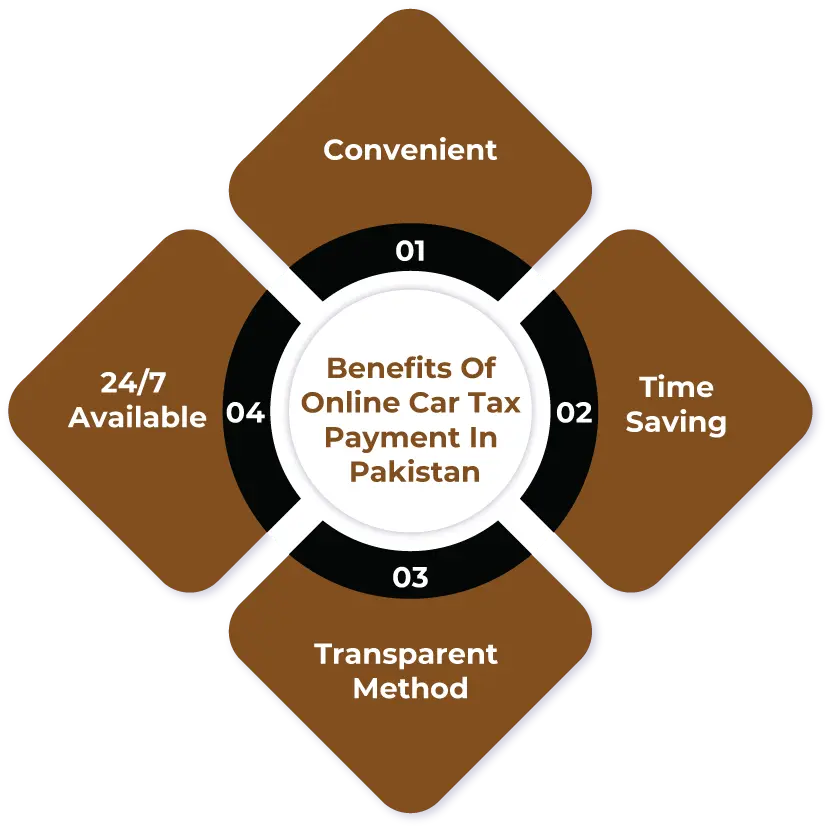

Benefits Of Online Car Tax Payment In Pakistan

Now, the method of how to pay car token tax online might be clear here. Let’s discuss the benefits the e-payment method gives to car owners in Pakistan.

- The online tax payment is a convenient method. It makes it simpler to make payments from anywhere without needing to visit the office.

- It is also a time-saving method, so you don’t need to stand in long rows waiting for your turn.

- Online payment of car token tax is also a transparent method that keeps a clear record of payment.

- You can pay the token tax anytime because it is available round the clock.

End Note: Know Before Proceeding!

Mostly, people get confused and ask the common query: How to pay car token tax online? To eliminate the confusion, the method is simplified here in this blog. Whether you are interested in a Car token tax check, Token tax Punjab online payment, or KPK, Sindh, and Balochistan token payment. We have provided each detail to simplify the renewal of token tax and its payment. This comprehensive blog gives details about the advantages, preconditions, payment methods, and renewal of the car token tax. Take a moment and understand all these important steps before directly proceeding towards the payment of car token tax in Pakistan.